This week’s Autumn Statement by Britain’s Chancellor of the Exchequer, Jeremy Hunt, was a miserable affair, full of political chicanery with little to effort to tackle the country’s deepening problems. Worse yet, the opposition parties (Labour and the Lib Dems anyway), for all their huffing and puffing, are also unable to face up to these problems.

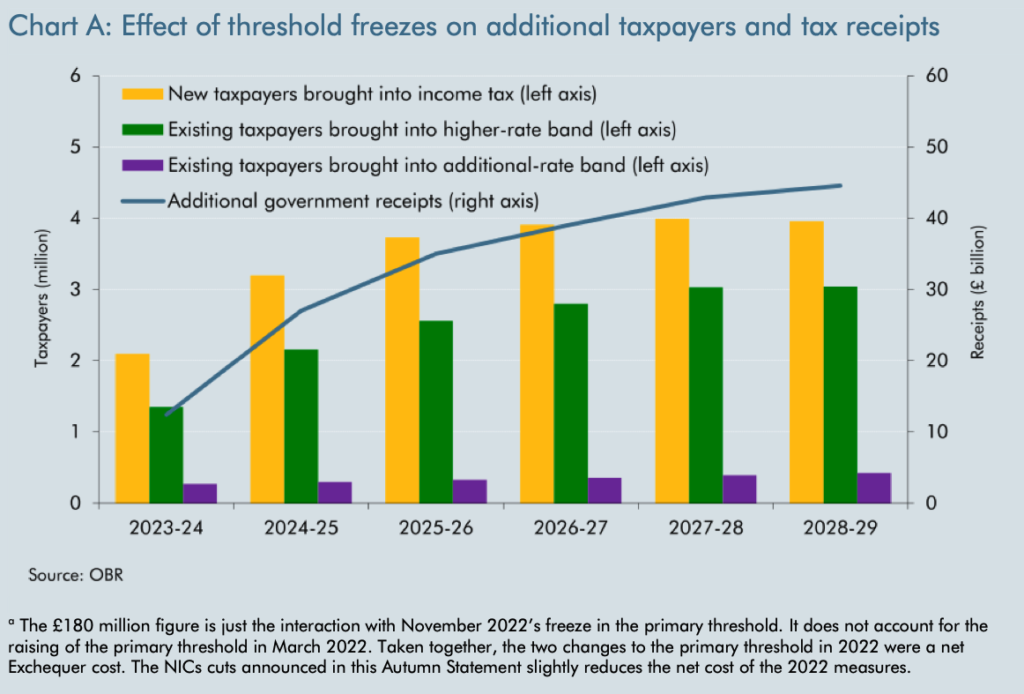

The Conservatives billed the set of measures as the biggest set of tax cuts since the 1980s. And yet the overall tax burden is rising as the freezing of tax allowances and thresholds will bring ever more people into tax or higher rates of tax, and increase the proportion of income people pay as tax. An even bigger problem is that the government has been using inflation to squeeze public spending, while services across the board – health, education, the police, the courts, and the list goes on – are clearly overstretched and in many cases breaking down – with collapsing buildings and rising waiting lists. The Chancellor offered not a penny to alleviate this crisis, while planning a further squeeze in the years ahead. Labour and the Lib Dems gleefully pointed out the first problem, but failed to address the second. They will stand by the announced tax cuts, while offering only gestures (taxing non-domiciled residents, or private schools, for example) to help fund public services. These tax-raising wheezes are nowhere near enough to match the scale of the crisis. Meanwhile all parties suggest that a bonanza of economic growth is coming to the rescue, without acknowledging the severe headwinds that will limit the country’s long-term growth prospects.

I am also highly sceptical of the one measure that seems to be getting widespread support – the full expensing of investment in machinery and systems against corporate profits. It is said that this will boost business investment, which is sorely lacking. It is in a fact the revival of a policy that failed in the 1980s, and was abolished by Nigel Lawson, the Tory tax-cutting Chancellor, who has been about the only holder of that post in memory that had a grasp of how the tax system as a whole worked and could be reformed. Back then it created a tax-avoidance industry and encouraged wasteful investment with fancy kit, rather than the thinking through of business processes which is the real key to improved productivity. That fiasco occurred at the beginning of my professional career as a Chartered Accountant, where I could see the nonsense it was creating up close. Alas the current crop of politicians and their advisers are too young to remember this. And it is of little use to new businesses, where the need is most acute, as these typically do not generate enough profit for this to be of use. What a silly waste!

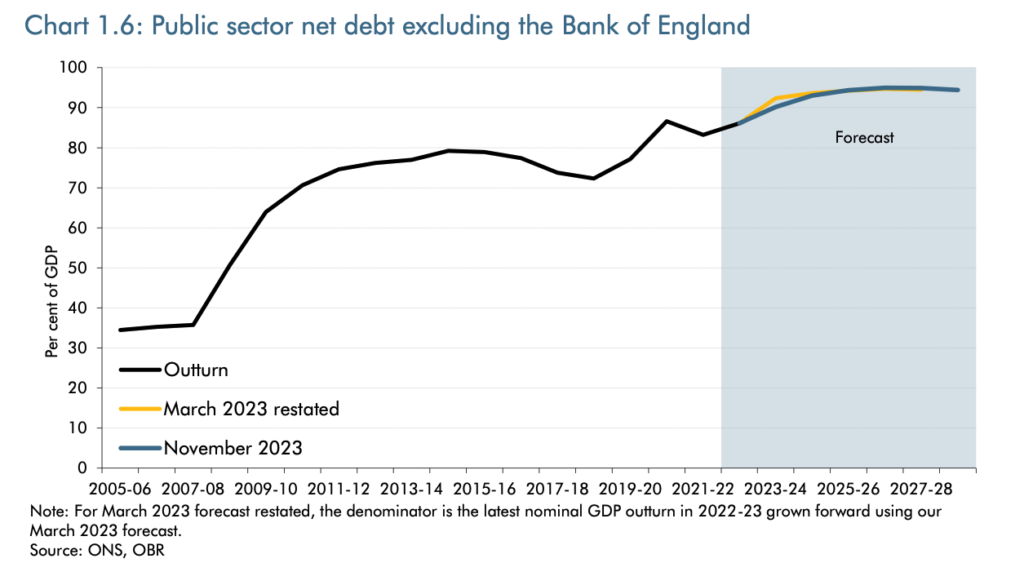

Meanwhile the fiscal climate is getting a lot worse. Interest rates are rising at time that the size of the national debt is historically very high. If interest rates are higher than the overall rate of growth, and there is a budget deficit, then a debt spiral threatens, which, if it leads to an international loss of confidence in the public finances, could usher in a severe financial crisis. At the moment it is actually quite hard to understand how much of a problem this is. You should be comparing real interest rates to real growth rates – i.e. after inflation. But there are mixed signals on real interest rates. If you compare the nominal rate on government lending, it is if anything less than reported inflation – indicating a negative rate. But yields of index-lined bonds are positive and have risen sharply. Meanwhile the budget deficit is quite high – at 4% of GDP. It wasn’t so long a go when none of this seemed to matter. Interest rates were low, and the Bank of England’s Quantative Easing (QE) programme made large government debt look manageable. But conditions have changed. Inflation has made money much tighter – with interest rates rising, and QE going into reverse. I am starting to suspect a deeper change is afoot in the world’s capital markets. Earlier this century a number of countries ran large trade surpluses – notably China, Japan and Germany. This made trade and budget deficits more stable in countries like the UK and US, as the surplus countries had plenty of spare currency to provide funding. As the world’s trading environment is getting more difficult, this may changing – though it is not yet evident in public statistics. After over-reacting to fiscal risks in 2010, and moving into austerity too quickly, the opposite risk beckons. But the Autumn statement proposes tackling the budget deficit only slowly, leaving the very high level of net debt virtually unchanged. Politicians seem to assume that as inflation comes down things will simply go back to the easy financial environment that pertained before. This is complacent.

If that is complacency, the politician’s attitude to economic growth is outright denial, though some economists who should know better seem to be in the same place. It is assumed that the UK’s poor performance has an easily fixable cause. More investment perhaps, or encouraging more people into work, or perhaps lower taxes. Rachel Reeves, Labour’s Shadow Chancellor, blithely talks about sorting out public services through economic growth – even applying the first-person to the process, as if growth was the gift one individual, and not the collective result of many millions of decisions. International comparisons seem to show that Britain’s productivity lags against peers. All that we need to do is fix this, the argument goes, and we will unlock growth. Well it may be that a burst of catch-up growth that is obtainable – but I suspect that these comparisons reflect an irreversible de-industrialisation, when a swathe of high-productivity industries left the country in the 1980s and 1990s and will not return. But stepping back, most or all of the developed world faces a number of headwinds that reduce growth potential, and in some case send it into reverse:

- Demographics: more people are retiring as lower birth rates take their toll. Immigration can make up some of the difference, but is politically fraught, and stresses housing resources.

- Trade: as globalisation runs into reverse, gains from trade are turned into losses. The UK is spared the American obsession with “near-shoring” or the reversal of the off-shoring of industries – but we have our own demons unleashed by Brexit.

- Overdevelopment. The increasing consumption of goods, a critical driver of past growth, is simply a phase in economic evolution that has clearly ended. People move on to improve their quality of life in other ways. Meanwhile massive increases to the productivity of manufacturing industry mean that its impact on the total economy is much reduced. All this means that lower productivity parts of the economy, including many public services, loom larger. Productivity gains are harder to get, and where they happen the result is not so much increased production, but a transfer of resources to low-productivity sectors.

- The energy transition. The country needs to make big investments to sources and distribution of energy, and its more efficient consumption. While the end result is desirable, in the meantime this will push down consumption. This, in fact, applies to pretty much all forms of investment. The country has become used to high consumption and low savings – reversing this won’t necessarily reduce growth as it usually measured, but to many people it will feel that way.

- Housing. One way of achieving growth, or at least burst of catching up, is to allow people to move to places where the most productive jobs are. But these areas lack enough housing to accommodate this. Britain’s house builders have growth rich on the skilful management of land portfolios, rather than the actual building of houses, which many are actually very bad at. They have no incentive to increase the pace of building. And if the pace is increased, skill shortages quickly become evident. And I haven’t even mentioned slow and restrictive planning processes. Politicians at least show some awareness of this issue, but action never matches the promises.

The days of steady economic growth over the medium to long term are over, whether we like it or not. The best we can hope for is a short-term spurt. There is plenty of potential for human wellbeing to improve, but this will manifest itself in other ways.

The central problem is the funding of public services and maintenance of social safety-nets. A combination of two things are required here. The first is higher levels of taxation – and mainstream taxes which directly affect demand, and not gimmicks around capital and wealth (the latter may help make debt more manageable, but won’t suppress demand and prevent inflation). The second is a radical reform of public services so that demand for them is reduced – reducing the level of social problems, so that we require fewer police, courts, hospital beds, etc – and managing those problems so that they are solved early rather than passed from agency to agency. Alas we have very little idea how to bring such a change about – though we can see that some countries do this better than us (Japan, Switzerland, Denmark perhaps). A radical reform of government is clearly a part of this, with less centralised control – but it needs much more than this: decentralisation by itself could actually make things worse. With the possible exception of education (which has become more effective rather than cheaper) the reform efforts made by our governments in the last twenty years have taken us in the wrong direction – from Labour’s over-centralisation, to the de-skilling and outsourcing of the Conservative and coalition years. Unfortunately the choice between the two approaches of higher taxes or radical reform is not a binary one. Reform will require substantial investment, and that is likely to mean higher taxes in the short term at least.

If our politicians are in denial about all of this, how about the public? They surely understand that public services are in a dire state – and that fixing this will not come cheap. But they are too wrapped up in their own personal struggles to spend any energy on demands for change. Politicians are in denial for a reason: they don’t just a lack imagination and perception, but they also know a voter-loser when they see it. Still, Labour are clearly presenting a more realistic prospectus than the Conservatives, even if it is based on wishful thinking. Their poll lead at least seems to show some wider awareness by the public at large. And we must grasp at that straw.