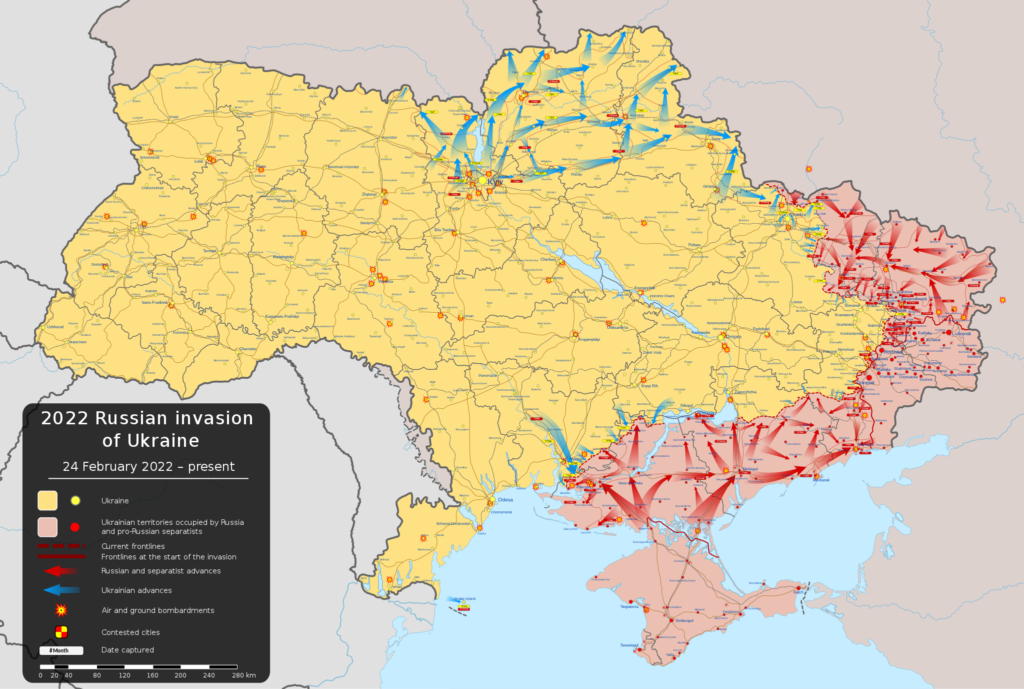

It is now six months since Russia launched its full-sale war against Ukraine, though hostilities started all the way back in 2014, with the seizure of Crimea. Not much changes day to day on the ground, and it is hard to tell if either side has an advantage. All the talk is of a long war and stalemate. It looks as if this is now Russia’s strategy. Will it work?

I last commented on the war in July. I mentioned then that my two main sources were The Economist and the Institute for the Study of War. The former is by far the better for getting an overall perspective. In the last print edition it had three interesting articles, on Ukraine’s prospective counteroffensive in the south, on life in occupied Ukraine, and a more general one on urban warfare. As somebody who can’t quite let go of his boyish enthusiasm for for military things (I still play with model soldiers), I find its coverage of military thinking of interest. It is, of course, very journalistic. It reports a number of points of view without being clear about the conclusion. In previous blogs I have expressed my frustration with its frequent repetition of the “conventional wisdom” that attackers need a three-to-one numerical superiority. It is clear that this piece of nonsense is actually quite embedded amongst western military theorists. This is a demonstration that the money-machine of the defence industry has a large bullshit factory attached. I shouldn’t have been surprised. All that can be said is that things look even worse in Russia, but at least Ukraine has demonstrated a capacity for intelligent pragmatism in military matters. That is doubtless a reflection of the extreme pressure they are under. They can’t afford bullshit.

ISW provides a bit more detail around the edges, but its quality has fallen off. It has a strong pro-Ukrainian bias. I mentioned in my last article that it nevertheless reported interesting colour from Russian “milbloggers” – commentators with military connections that were often critical of the Russian military leadership, though not of the war itself. Alas this source is a lot less interesting these days. The Russian government seems to be curbing it.

What do I learn from these sources? Well, not very much seems to be happening on the ground at all. Russian attacks in Donbas are slowing down, now that the more obvious targets, such as Severodonetsk have fallen. They are shifting strength to the south, in anticipation of a Ukrainian counteroffensive there. This counteroffensive has been talked up for the last couple of months or so, but not much seems to be happening on the ground, beyond an intensifying artillery battle, with Ukraine using its new advanced munitions to attack Russian logistics. The Economist is suggesting that the whole thing might be a feint. They don’t think the Ukrainians are ready yet. It is hard to tell how much of this assessment is based on hard reality, and how much is from the same western bullshit factory that thought the Russians were going to secure a rapid victory, and who keep talking about the need for a 3 to 1 numerical superiority for an attacker. The critical factor is the morale of Russian forces – which seems to be weak, since they depend so much on hastily raised and poorly trained and led units. These are the raw materials of a spectacular military disaster. On the other hand, plentiful Russian artillery presents a major problem for the attackers. And the Ukrainian military would be right to be wary of sending in inadequately trained forces. They can’t repeat Russian tactics.

With the situation on the ground moving to stalemate, more emphasis is going on symbolic and propaganda attacks. Ukraine’s attacks on Crimea look to be such, the area having been considered safe enough for Russians to use as a holiday resort. and so do occasional Russian long-range attacks on targets in Ukraine’s interior.

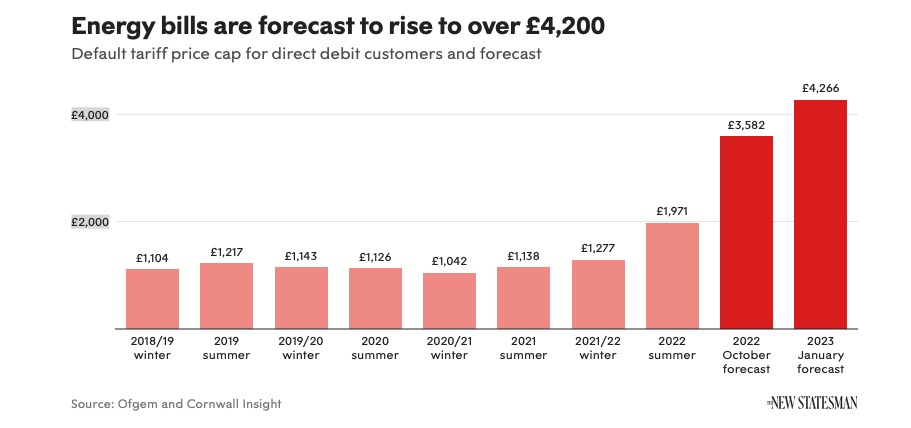

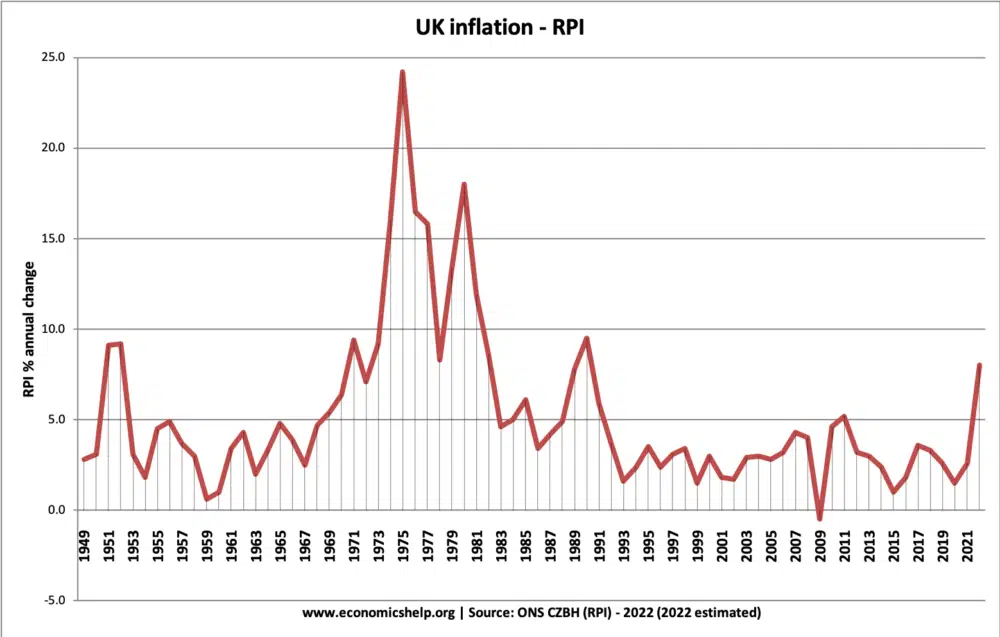

Meanwhile the Russian leadership thinks time is on its side. It’s not hard to see why. Ukraine is becoming more dependent on advanced western equipment and munitions, but these are expensive and supply capacity is constrained. Meanwhile the economic war with the West seems to be going quite well for Russia. Its economy is bearing up to sanctions better than expected. Meanwhile high energy prices are causing a major economic crisis in both Europe and, to a lesser extent, in America. There are signs of stress in the West’s political pro-war political coalition. The far right look as if it will come out on top in Italy; Emmanuel Macron has lost his parliamentary majority; Donald Trump looks ascendant in the US. Russia’s President, Vladimir Putin, has a low opinion of the moral fibre of the West. He surely thinks that Western resolve will collapse.

But that is to underestimate the strength of the West – a bit like the many Brexiteers thought the European Union was on the verge of collapse. It is hard to appreciate the strength of something you despise. Germany is the bulwark. Britain has found it politically convenient to back Ukraine’s war, and that will not change, even as it changes prime minister. Donald Trump is two years away from re-entering the White House – and his campaign may well collapse before then. Germany had staked a lot on a cosy commercial relationship with Russia, and access to its gas. Russia has betrayed the trust Germans placed in it, and the country understands that there is no going back. And so before our eyes that country s accomplishing a major economic realignment. The cost is enormous but the country is ready for it.

And meanwhile Russia has weaknesses of its own. Its army was never as effective as many thought, and now it is short of trained manpower and leadership. The problem will take years to fix. The government may have the political will, but it lacks the technical competence. Mr Putin has developed a highly effective internal security apparatus and propaganda machine, but beyond that Russia is being hollowed out.

So where does it end? The world is getting another lesson in how modern wars are easy to start and hard to end. As the war goes on, the stakes rise. What starts as a matter of geopolitical manoeuvre is sold as a clash of civilisations. In the early part of the war (or this phase of it), I speculated on what sort of a settlement might result. Such a settlement, with territorial losses to Ukraine, may come about if American patience is exhausted, and it forces Ukraine’s hand. That looks a long way off. The rise of Mr Trump, and President Joe Biden’s weakness, ironically, makes such an end less likely. Mr Biden can’t afford another embarrassing retreat after Afghanistan. Otherwise it will take regime change in Russia to end the war. It is hard to tell what might precipitate that. Mr Putin looks as secure as ever.

So the world has to endure yet another lesson in the futility of war.