The state of the world economy is worrying economists. GDP growth is lacklustre in the developed world, which in turn poses problems for the developing world. That’s bad enough, but the economist’s nightmare of deflation – prices dropping rather than rising – now beckons around the world. And yet the prescriptions of most economists are shaped by a way of looking at the economy that belongs to the past. A paradigm shift is needed. Debt is at the heart of it, not GDP growth.

The state of the world economy is worrying economists. GDP growth is lacklustre in the developed world, which in turn poses problems for the developing world. That’s bad enough, but the economist’s nightmare of deflation – prices dropping rather than rising – now beckons around the world. And yet the prescriptions of most economists are shaped by a way of looking at the economy that belongs to the past. A paradigm shift is needed. Debt is at the heart of it, not GDP growth.

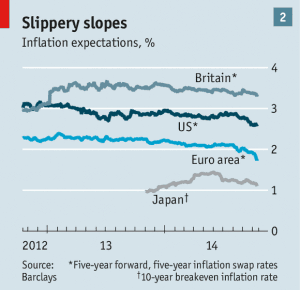

For a clear, conventional analysis of the issue read this week’s Economist. Here’s a brief summary. The developed world economies are suffering from deficient demand. In other words, the economies could easily churn out more goods and services, using existing capital and labour, but don’t because people aren’t asking for the stuff or can’t pay for it. Another way of putting this is that the amount of investment (people spending money on building capital rather than the immediate consumption of goods and services) is less than the amount of saving (the amount by which people’s income exceeds the goods and services they consume). This leads to low growth rates. Now inflation is falling and deflation threatens. Deflation is bad, at least when low demand is its cause, because it makes debts more difficult to repay, and this gunges up the financial system, which makes matters worse.

The conventional answer to this problem, which also goes under the name of “secular stagnation”, is to reduce the prevailing rate of interest. This will encourage people to invest more since the returns to investment, compared to simply sitting on piles of money, would then be higher. But deflation, or low inflation, makes this impossible, because it raises the floor – the lowest real (after inflation) interest rate it is possible to charge. Answer: you raise the level of inflation. The method of doing this is to increase the money supply, since inflation is a monetary phenomenon. All sorts of ingenious ways are then dreamt up of how to do this. But this is all the product of a conventional way of thinking based on aggregate economic statistics, rather than what is really happening in developed societies.

There a number of challenges to make:

- Stagnation, in and of itself, is not necessarily a bad thing in the developed world. Surely the current level of consumption of goods and services is sufficient, in aggregate, to secure perfectly decent wellbeing for everybody – and economic growth is not the most efficient way to securing improvement to that wellbeing. And as we judge the potentially catastrophic impact of man’s demands on the planet it is clear that a system based on ever increasing consumption cannot end well. We need to make better choices about what we consume, and distribute the consumption more evenly. But economists seem to worry about the speed of the train, rather than where it is going, or even whether it has arrived at where the passengers want it to go.

- Inflation in the modern, developed world does not work in the way the economic textbooks suggest. In particular the rate at which monetary wages rise has become detached from the rate of increase of consumer prices. Macro-economic policies, like monetary policy, aimed at increasing inflation may feed through to consumer prices without doing much for wages. This completely undermines the supposed benefits of a little bit of inflation.

- Things are no better in capital markets. Reducing interest rates seems to have little effect on levels of genuine, productive investment. Such investment is driven much more by zeitgeist than interest rates. Excess money either chases a relatively fixed pool of existing assets (land and buildings and shares), or it simply piles up in bank accounts. This makes conventional monetary policy very hard.

We can look beyond these challenges to recognise some issues that might be behind these challenges. Interestingly, these are, for the most part, not particularly controversial amongst modern economists – it is just that they seem unable to accept the implications:

- Distribution of wealth and income matters more than aggregates. This is the complete opposite of late-20th century conventional economic wisdom. The problem is that wealthy people have too much income to meat their needs, and that there are inadequate channels to invest the surplus productively (as opposed to bidding up property values, etc.). To try and balance out the deadening impact of this, the answer has been to get poorer people to consume more by piling up debt. That would be fine if those poorer people turned into rich people later in their lives – but that is not what is happening. This is unsustainable – and yet most conventional economic advice boils down to cranking this system around one more time.

- Modern businesses require much less capital investment than previously. The modern business giants of Microsoft, Apple and Google never needed much debt and did not need much capital to get going. This is simply the way that technology has evolved. There remains demand for public infrastructure: railways, hospitals, power stations and so on, but the risks and returns, and their often monopolistic nature, makes this a difficult area for private businesses, as opposed to governments, to lead. This is one aspect of what economists refer to as “Baumol’s disease” – the paradox that the more productive the efficient areas of an economy become, the more the lower-productivity areas predominate in the economy as a whole.

- Globalisation has changed economic dynamics profoundly. Amongst other things it has weakened the bargaining power of workers – one reason that prices and wages are becoming more detached from each other. Also, less talked about and perhaps controversially, I believe that globalised finance means that developed world governments have less control over their currencies and monetary policies. This is one reason why it is more difficult to use monetary policy to manage inflation. It is also the reason that Europe’s currency union makes much more sense than conventional economists allow – but I digress.

- Technology is changing the way the jobs market is working. Many middle-range jobs, in both manufacturing and services, are disappearing. This week Britain’s Lloyds Bank announced the loss of 9,000 such jobs in its branches and back office. This, and not the flow of immigrant labour, is the reason why the labour market has turned against so many.

- And finally, I think that many consumers appreciate that additional consumption, and the income to support it, are not the answer to improved wellbeing. It is better to stop earning and pursue low-cost leisure activities. I notice this most in middle-aged middle-class types like me – who are retiring early. It is perfectly rational. And yet economists can’t seem to understand why reduced consumption and income might be a rational choice for an individual. There is a tendency to tell us to go out and spend more for the good of the economy. This is a perfectly liberal and rational downward pressure on national income – which surely should be encouraged for the sake of the planet.

Some of the consequences of these trends are straightforward. Redistribution of income and wealth are now at the heart of political and economic policy, rather something that can be ignored. A much greater proportion of economic investment must be government-led, which imposes a massive challenge for political management. Governments and central banks trying to tweak the inflation rate by a few percentage points is a fool’s errand. Also trying to revive the economy by getting the banks to lend more money to poorer people is unsustainable, even if the lending is collateralised on residential property. The appeal by many economists, such as the FT’s Martin Wolf, that developed country governments should borrow more to invest in infrastructure makes a lot of sense. Using monetary policy to help finance such investment makes sense too. Making sure this investment is directed sensibly is a bigger problem than most allow, though.

And the conventional economists are right to worry. A world of stagnant growth and low to negative inflation creates major problems. In particular many debts, in both private and public sector, will not be repayable. At some point there will be default, since the other options, inflation and growth, are off the table. Or to put it another way, much of the financial wealth that many people currently think is quite secure is anything but, in the longer term. This may a problem for many pension and insurance schemes, as well as wealthy individuals and corporations.

The consequences of this are quite profound. Our society must break its addiction to debt. The banks and the financial sector must shrink. “Leverage” should be a rude word in finance. If low growth is the result, or if a new financial crisis is hastened, then so be it. Let us learn to manage the consequences better. Borrowing to support genuine productive investment (not excluding the building of new houses where they are needed) is to be encouraged, including government borrowing to finance public infrastructure. But other borrowing must be discouraged. Taxation should increased, especially on the wealthy. If that causes a loss of productivity, then so be it – this should be compensated by more efficient financial flows from rich to poor. Political reform must run in parallel to ensure that public investment is conducted efficiently, rather than just disappearing into the pockets of the well-connected.

This is a daunting programme. Stagnating national income and deflation are not inevitable consequences – since these policies do address some of the causes of deficient demand. But we must not think that these statistics are the lodestars of public policy. We need a much more nuanced appreciation of the wellbeing of our planet and the people that live on its surface, and put it at the heart of economics.

Such sound eco